Keys to Successful Advocacy: Understanding and Maximizing Your Association’s Tax Status

Do you know your association’s federal tax status? Moreover, do you know which political activities your association’s tax status allows and which it prohibits? One way to maximize your association’s legislative influence is by continually educating leadership on the kinds of activities that their tax status allows them to do.

As noted in an earlier piece on political action, many organizations shy away from politically-related activities out of concern for their tax status. Despite IRS attempts at clarity, there remains a great deal of confusion regarding the scope of political and lobbying activities that are allowed. Uncertainty in this area often causes organizations to be overly cautious. Your association’s board should discuss specific concerns about political involvement with legal and tax experts, but the basic guidelines below about the political activity permitted for the most common types of tax-exempt organizations can serve as a starting point for creating your legislative strategy.

Attempting to influence legislation

• Any effort to affect the opinions of the general public (grassroots lobbying), and

• Any communication with a member or employee of a legislative body or with a government official who may participate in the formulation of legislation (direct lobbying).

• “Legislation” includes measures considered by Congress, state legislature, local council, or by the public in a referendum / ballot initiative.

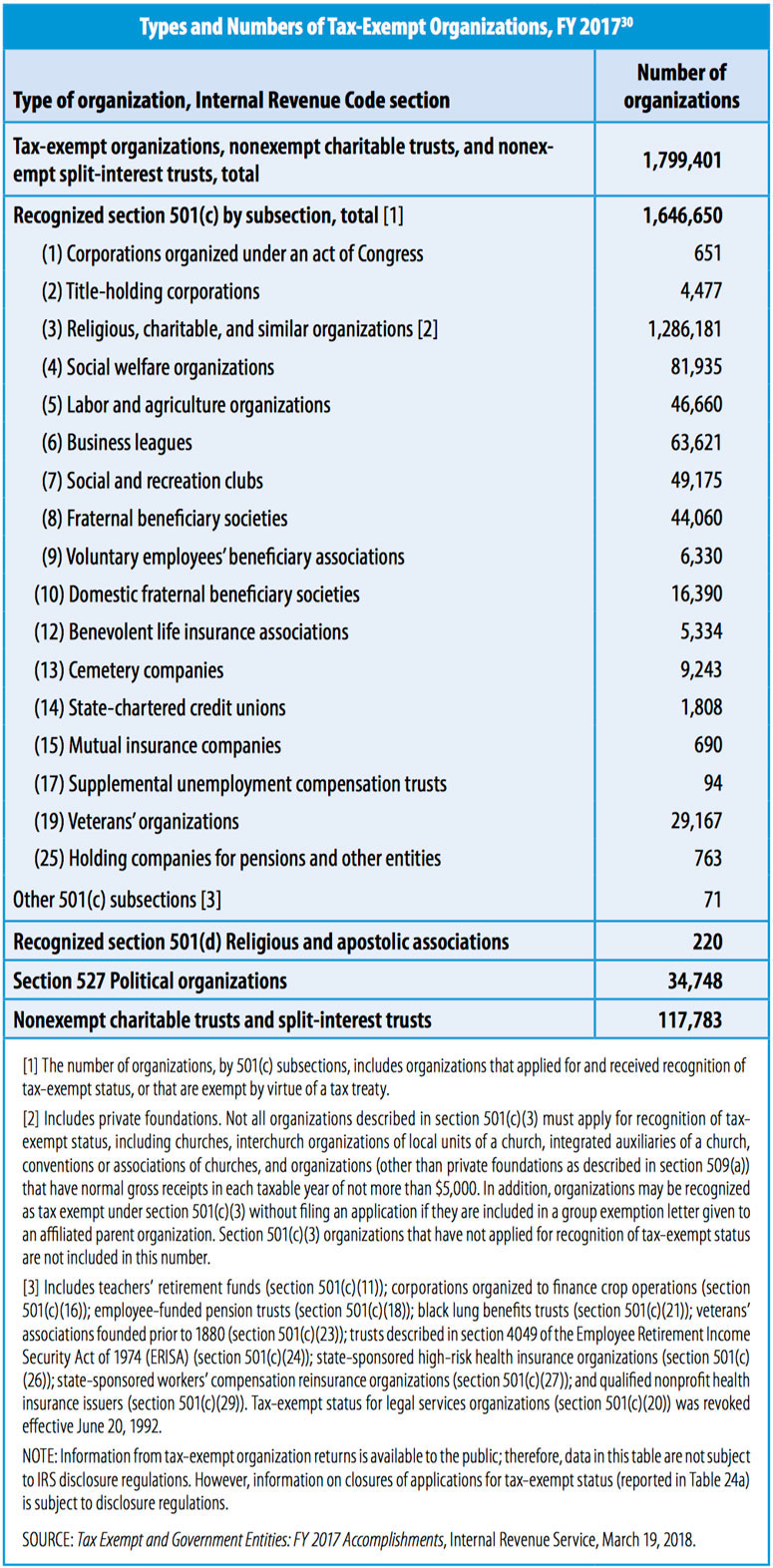

The IRS recognizes more than two dozen types of tax-exempt organizations; including cemetery companies, retirement funds, and Black Lung Benefit Trusts; each with different rules when it comes to lobbying and tax-deductible contributions. Here are three common types of tax-exempt organizations:

501(c)(3) organizations

The most common tax-exempt designation is 501(c)(3). These types of tax-exempt organizations are defined as being organized for religious, charitable, scientific or literary purposes. They include professional societies if its purpose is to advance the profession with respect to educational activities. These organizations have the best tax treatment under federal tax law: They are tax-exempt, and contributions to them are tax-deductible. The trade-off for these benefits is a prohibition on public support for or opposition against any candidate for public office. A law firm describing the extent of this ban points out that it applies even if the public office is not partisan. For example, the Association of the Bar of the City of New York lost its 501(c)(3) status when the association attempted to rate candidates in elective judicial races on a nonpartisan basis.

When ambiguous situations arise regarding the legality of a 501(c)(3)’s political activity, the IRS employs a “facts and circumstances” test that evaluates the timing of the organization’s communication, “its targeted audience, and how the message relates to public policy positions that distinguish candidates in a campaign.”

Outside of support for candidates for elected office, a subset of 501(c)(3) organizations may attempt to influence legislation within certain limitations. Public charities may engage in lobbying so long as those activities do not amount to a “substantial” part of the charity’s activities, a determination made by the IRS on a case-by-case basis. Private foundations, on the other hand, are essentially prohibited from that kind of activity because they are funded by a single source and therefore represent a single voice. Given these limitations, and in light of a 2017 law that withdrew a tax incentive for charitable contributions, analysts expect money to flow into 501(c)(4) organizations, another kind of tax-exempt entity that may engage in political activities.

501(c)(4) organizations

501(c)(4) organizations have become the most visible and politically active tax-exempt organizations since the U.S. Supreme Court’s 2010 Citizens United decision allowed corporations and labor unions to spend an unlimited amount of money on politics. The Center for Public Integrity reports that, “The IRS says politics cannot be the primary purpose of these nonprofit groups but that rule is rarely if ever enforced.” 501(c)(4) entities are the vehicle for so-called “dark money” contributions. Like super PACs, they can collect unlimited contributions from most any source, but unlike super PACs, they are not required to disclose their donors. Eighteen 501(c)(4) organizations spent more than $1 million during the 2018 election cycle, with spending for the top five reaching almost $70 million

Columbia Law School professor David Pozen points out, “conservative social-welfare organizations such as Americans for Prosperity and Crossroads GPS spent massive amounts over the past several election cycles. Liberals initially responded with alarm at the ‘politicization’ of the 501(c)(4) category. Now they are following suit.”

Professor Pozen concludes, “Amid all this uncertainty and change, one point seems clear enough. For the foreseeable future, the nation’s political welfare will increasingly be bound up with social-welfare organizations.”

501(c)(6) organizations

501(c)(6) membership-based organizations promote a business interest and are usually incorporated as a professional society or trade association. These groups may engage in a wide range of lobbying, but, like a 501(c)(4), campaigning cannot be its primary activity. i.e., lobbying expenses cannot exceed 50 percent of the association’s expenditures. Also, members of the association cannot claim the percentage of membership dues devoted to lobbying activities as a tax-deductible business expense. Naylor Government Affairs works closely with association management staff to determine this figure. In one case, a professional society clearly stated on its annual dues statement that 37% of dues would be expended for lobbying expenses and would not be deductible for federal income tax purposes. Much of that expenditure is comprised of the society’s contribution to the administration of its federal political action committee. Indeed, it is not uncommon for 501(c)(6) organizations to sponsor a PAC to advance their political agenda while pursuing lobbying as a key function of the parent organization.

Complex laws regulate whether and how a tax-exempt organization may engage in political and lobbying activities. While associations shouldn’t shy away from political action, lobbying, or even funding a PAC if these activities support their policy priorities, leaders must be well-versed on the rules so the organization can best represent its members and their profession.