Joint Surveys and the Importance of Knowing Your Industry

My last article discussed the importance of knowing your members and gave some tips about how best to do that. Here I will discuss the importance of knowing your industry in depth, not just your members.

As part of my role at Naylor Association Solutions I oversee the marketing for several education-related associations. When looking at how to improve our knowledge of these associations we were faced with a choice: Create 10 different surveys (one for each association) or send out one industry-wide survey. We opted to send out one industry survey.

As an association professional, I am sure several questions just popped into your head:

- How do we organize something like this?

- Isn’t that too complicated, and will my members be confused?

- How will this benefit me?

High performing associations are not only surveying their members; they’re taking the pulse of entire industries they represent.

There are many benefits to partnering with other associations when conducting an industry-wide survey.

After doing all the hard work to field, collect and analyze your data, don’t forget the most important step—presenting it effectively and sharing it with others.

Allow me to tackle these questions one at a time, with some real-life examples below:

- How do we organize something like this? Organizing a survey of this magnitude is not as difficult as you might think. The first step is to figure out which associations you would like to partake in this joint survey. If you are a national or statewide association and have smaller regional associations, include them in the survey. If you are a state-based association, reach out to your counterparts in other states and ask them to participate.

For example, an education association based in Oregon may want to communicate with education associations in neighboring Washington, Idaho, Nevada and California. Once you have picked your partners, reach out to them and ask if they want to partake in your survey. Most associations will be happy to have the same industry information you are seeking and say yes. If they say no, don’t be discouraged; continue to ask other associations.

- Isn’t that too complicated, and will my members be confused? Much in the way you would use a survey tool to create your own survey, this industry survey will have many of the same questions with two important differences. The first will be an intro paragraph (in your launch email and survey) that explains to members what you are trying to accomplish.

For example, “In order to learn more about its members, your education association has partnered with other education associations to conduct this survey.” This is a clear way of explaining to members what the survey is and why they should care. Your members who also belong to other associations and will be happy to be surveyed just one time.

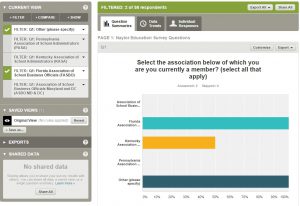

The second difference between an industry survey and your own member survey is the first question you ask. The very first question in the survey should be: “To which of the following associations below are you currently a member?” and then list the associations you partnered with in alphabetical order. This question will allow you to sort the answers so that you will know what your members answered, what their members answered, and what the whole industry answered. This one mundane question is key to the entire success of this survey.

- How will this benefit me? As mentioned above, you can filter the results of your survey by how a respondent answers the first question (“To which association do you belong?”). Survey experts call this cross-tabulating. This information is key to giving you a narrow view about what your members answered. This survey can take the place of the survey discussed in my previous article, Know Your Members Through Better Surveys. In fact, the questions asked here will be very similar questions (demographics, spending, titles, involvement in purchasing process, etc.). But now you can see what other associations your members belong to, and you can learn what your members spend on products and services in comparison to members of other associations, and what the common issues are that the associations are facing. This information can go a long way toward recruiting and retaining members, working with other regional associations to tackle common problems, and to learn what regional or local issues your members are dealing with.

Watch Kent explain the survey answer filtering process:

Presenting your results

Once you have completed your joint survey and the information has been parsed out to all the participants, an effective way to present the results is to create two infographics. The first infographic will detail just the responses your members gave. This information can be emailed or tweeted out to members or potential advertisers to let them know all the great information you found.

The second infographic you create will compile the industry-wide information. This will contain all the joint demographic information, spending information and member information. This could be published in a national publication, tweeted and emailed out. Bonus: By getting this information out there you can entice advertisers who may have an interest in advertising regionally to advertise in ALL the regional publications.

Conclusion

In short, conducting a survey to know your industry better not only helps you understand your members, but helps your members and advertisers understand your association, its strength and its reach. Associations are predicated on the idea that we are stronger together and that same principle applies to surveying your industry.

Kent Agramonte is a marketing supervisor at Naylor and has more than five years of experience helping associations with member surveys and data. Contact Kent if you’d like to learn more about how Naylor Association Solutions can help develop this type of industry survey for your association.