Know Your Members Through Better Surveys: A How-To Guide

When we discuss knowing who our members are, we sometimes speak in nebulous terms, such as “We need to find out what’s best for our members” or “How can we better serve our members.” We tend to put the how or what before the who.

Recently, I was talking to an association about some of the challenges they faced and the subject of who their members were was brought up. I was surprised that this particular association didn’t know exactly who their members were. Associations tend to put members into categorical groups as broad as “regular members,” which can lead to a lack of understanding of their members. To figure out what our members truly need from us, the first step is to find out who they are. But often, this key element of association management is overlooked.

The first step for a successful membership survey is to establish your goals.

When members see that you are making a concerted effort to understand more about them and their concerns, they see more benefit in being a member of your association.

Expressing numbers as ratios gives a human face to your members. Most people can picture “two out of three” people in their head, but a concept like 63 percent is harder to imagine.

Associations tend to commission studies of their industries as a whole. While that is a great way to gauge the overall health of the industries they represent, it may not gauge the health of your individual members’ businesses. An association-specific survey will help you directly gauge the health of your membership and future needs you must address.

Getting started

So where do we start? The first step in a successful membership survey is to establish its goal. If you are trying to figure out your members’ overall business health, it is important to look at three key factors:

- Demographics. Questions that ask about member titles, where they fall in the chain of command and whether or not they are the ultimate decision-maker for their organization can help you find out how influential your members are and the influence your association has within your industry.

- Economic factors. How much do your members spend on products and services each year? Do they expect their business to expand or shrink in the next 12 months? What is their organization’s revenue? These questions can help you find out the economic health of your members and will act as a benchmark for growth in future surveys.

- Member needs. Ask your members questions about what they need or want from your association. For instance:

-

- What issues are you and your company most concerned about?

- Is our association doing enough to focus on legislative issues that affect your business?

- What can we do to bring additional value to you, our member?

By asking these questions, we can begin to paint a picture of what your members are going through and the state of their businesses. This information is also key to generating non-dues revenue because it is vital information for any advertiser, sponsor or strategic partner that wants to reach your members.

Survey build and deployment

The second step in any successful survey is building and sending the survey. There are several free and low-cost survey tools that can help you generate basic surveys online. For example,SurveyMonkey offers a free, easy-to-use, basic version of their survey tool. Survey Gizmo is a low-cost alternative and offers a free trial. For more advanced metrics, try Qualtrics.

Disclaimer: Neither Association Adviser nor Naylor Association Solutions has a commercial or promotional interest in the products/services mentioned in this article.

Once you enter your questions into the survey tool, test the survey on yourself and make sure all question logic flows the way you intended.

When you are 100 percent confident that your survey is ready to be deployed (sent out), you may want to test it on a small sample of potential respondents before sending to your full distribution list. That’s called a pilot. It’s a good way to tighten up the wording or answer choices that may end up confusing respondents.

Most online survey tools will allow you to include a link to the survey in your member outreach efforts. Our suggestion is to email this link to potential respondents or include it in an eNewsletter to your members. If you do not have a way to mass email your members, MailChimp is a commercially available tool that is free to anyone with fewer than 2,000 subscribers.

Once sent, keep your survey open for at least two weeks (but not forever) and send an update email at the beginning of the second week to remind members to take the survey if they have not already done so. If you are worried about not getting enough responses to your survey, you should offer some type of incentive to take the survey. Gift cards go a long way to helping you get responses

From data collection to analysis

After two or three weeks, it is typically time to start looking at the results. Remember that you only need about a 10 percent response rate to make your survey statistically viable. For example, if you send your survey to 1,000 members (this is your sample size) and 100 members take the survey, than you can statistically project the results to your entire membership.

So, if 75 percent of respondents in a statistically generalizable sample are CEOs, then it would be safe to say that 75 percent of your members are CEOs. If you don’t meet the 10 percent threshold, then your results are still viable as “non-scientific” insight into your membership base. No, you cannot generalize to your entire association, but the small result pool will give you the overall pulse of members.

Once you have taken a look at the results, make sure to turn them into ratios if possible. For example, if 63 percent of your members say they are concerned about tax legislation, then it is better to say nearly two out of three members are concerned about tax legislation. Expressing numbers as ratios gives a human face to your members and allows people to better visualize results. Most people can picture two out of three people in their head, but a concept like 63 percent is harder to imagine.

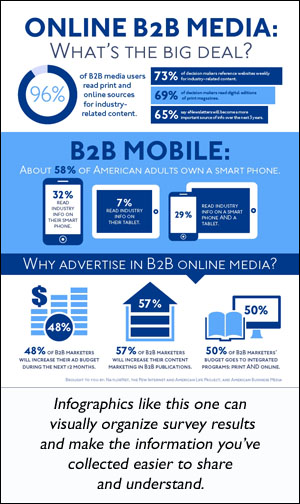

Results like the ones in your survey are interesting to you, your members, potential non-dues revenue generating advertisers and the industry as a whole. So it is a good idea to share them with as many people as you can. An easy way to accomplish this is to create an infographic with short bullets that details the findings of your survey. This infographic shouldn’t be much longer than a page and should be emailed to members, industry stakeholders and included in your official communications pieces as much as possible.

Surveys generally only retain their validity for about two years. So plan to send out member surveys every other year to make sure you will always have the most up-to-date information about your members.

Conclusion

Good research, with good information, adds value to your association, your association’s communications and your members. When members see that you are making a concerted effort to understand more about them and their concerns, the more benefit they see in being a member of your association. Learning about your members helps you learn more about your association’s goals and the direction your association should be heading while helping you recruit potential members and associate members. The brain always knows what the body is doing, but when it comes to association management, sometimes the brain needs a roadmap.

Kent Agramonte is a marketing supervisor at Naylor and has four years’ experience helping associations with member surveys and data.